Building a Thriving Home Business Without Traditional Loans 🏠🚀

Starting and growing a home business without relying on traditional loans may seem challenging, but it’s entirely possible with the

In the financial realm of business, creditworthiness plays a pivotal role. Business credit can often be an enigmatic concept for entrepreneurs, particularly those in their journey’s early stages. Let us solve the puzzle and explore how business credit impacts funding.

Business Credit: An Overview

Business credit refers to a company’s ability to borrow money. It is based on the trust lenders place in the business to repay the borrowed amount. A strong business credit score can open the door to more funding options, often with more favorable terms.

Determinants of Business Credit

Several factors determine your business credit score. These include your payment history to creditors, the amount of debt your business carries, financial performance, and public records such as bankruptcies or tax liens.

Importance of Business Credit for Funding

Maintaining a solid business credit score is crucial for securing funding. Lenders view businesses with good credit as less risky, making them more likely to approve loans or extend credit. Moreover, a good credit score can often lead to lower interest rates, saving your business significant money over time.

Building Business Credit

You must separate your business finances from yours to build your business credit. Regularly review your credit report for inaccuracies and establish trade lines with suppliers that report to credit agencies. Always strive to make payments on time and try to keep your credit utilization low.

Business Credit Beyond Loans

While loans are a prominent area where business credit plays a role, it is not the only one. Business credit can also affect your relationships with suppliers, the terms you are offered, and even your business insurance premiums.

Monitoring Your Business Credit

Monitor your business credit score regularly and address any issues promptly. Various credit reporting agencies, such as Dun & Bradstreet, Experian, and Equifax, can provide you with your business credit report.

Understanding business credit is like solving a puzzle. Once all the pieces are in place, you get a clear picture of your business’s financial health and attractiveness to lenders. Building and maintaining strong business credit, you will be well-positioned to secure the funding you need to grow and succeed. After all, in the world of business, creditworthiness is not just power; it is the gateway to opportunity.

Starting and growing a home business without relying on traditional loans may seem challenging, but it’s entirely possible with the

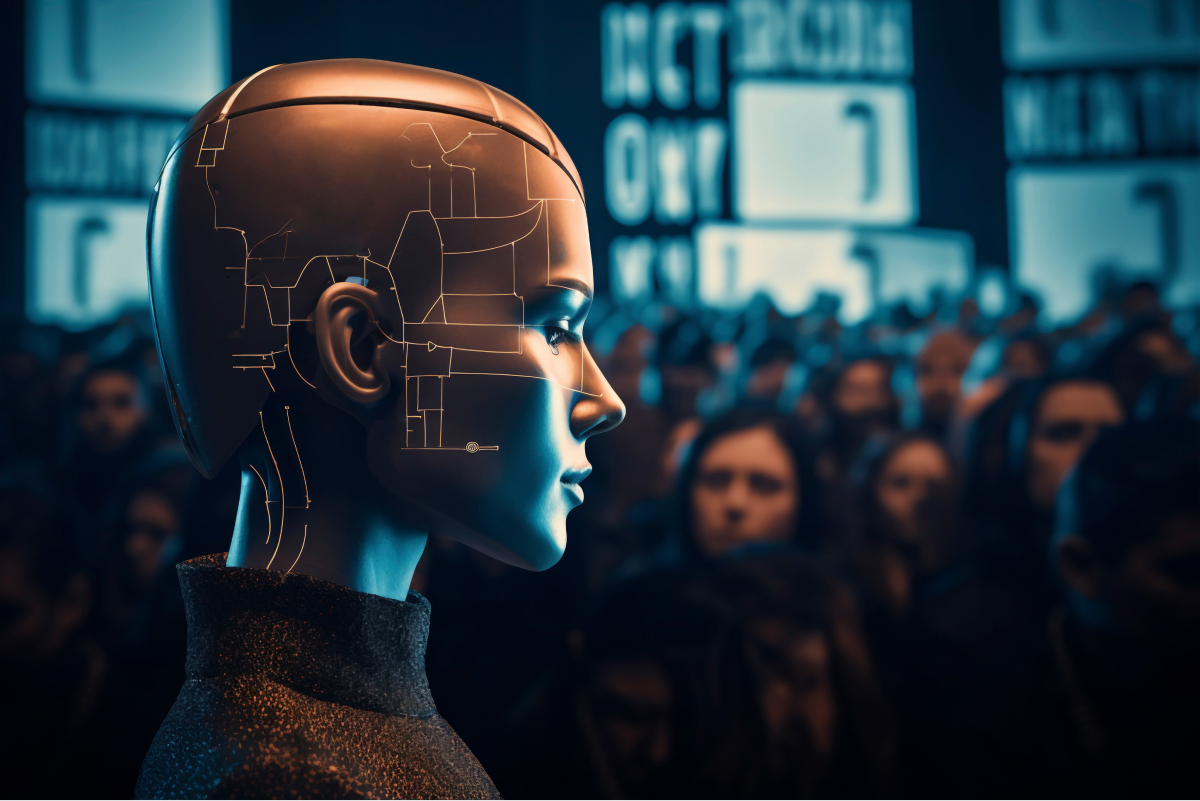

Artificial Intelligence (AI) is revolutionizing the business landscape, driving growth, and creating unprecedented opportunities across various industries. AI transforms how

Scaling a home business might seem daunting, especially with a limited budget. However, you can grow your business without breaking

No account yet?

Create an AccountBe the first to learn about our latest information and get exclusive offers

Will be used in accordance with our Privacy Policy